Finding a Proxy Data Supplier to Assist in Reporting Under the EU SFDR

The EU Sustainable Finance Disclosure Regulation (SFDR) is a set of rules introduced by the European Union to provide investors with more information about the environmental, social, and governance (ESG) characteristics of financial products.

If you are a financial market participant eligible for the SFDR, it may be necessary to find a proxy data supplier to help you calculate the ESG characteristics needed for SFDR disclosure. Proxy data allows you to estimate the SFDR performance of your portfolio companies based on the data of similar companies in the same industry and geographic region. Proxy data may be used to fill gaps in data not reported by your portfolio companies, or as a standalone estimation tool for your portfolio.

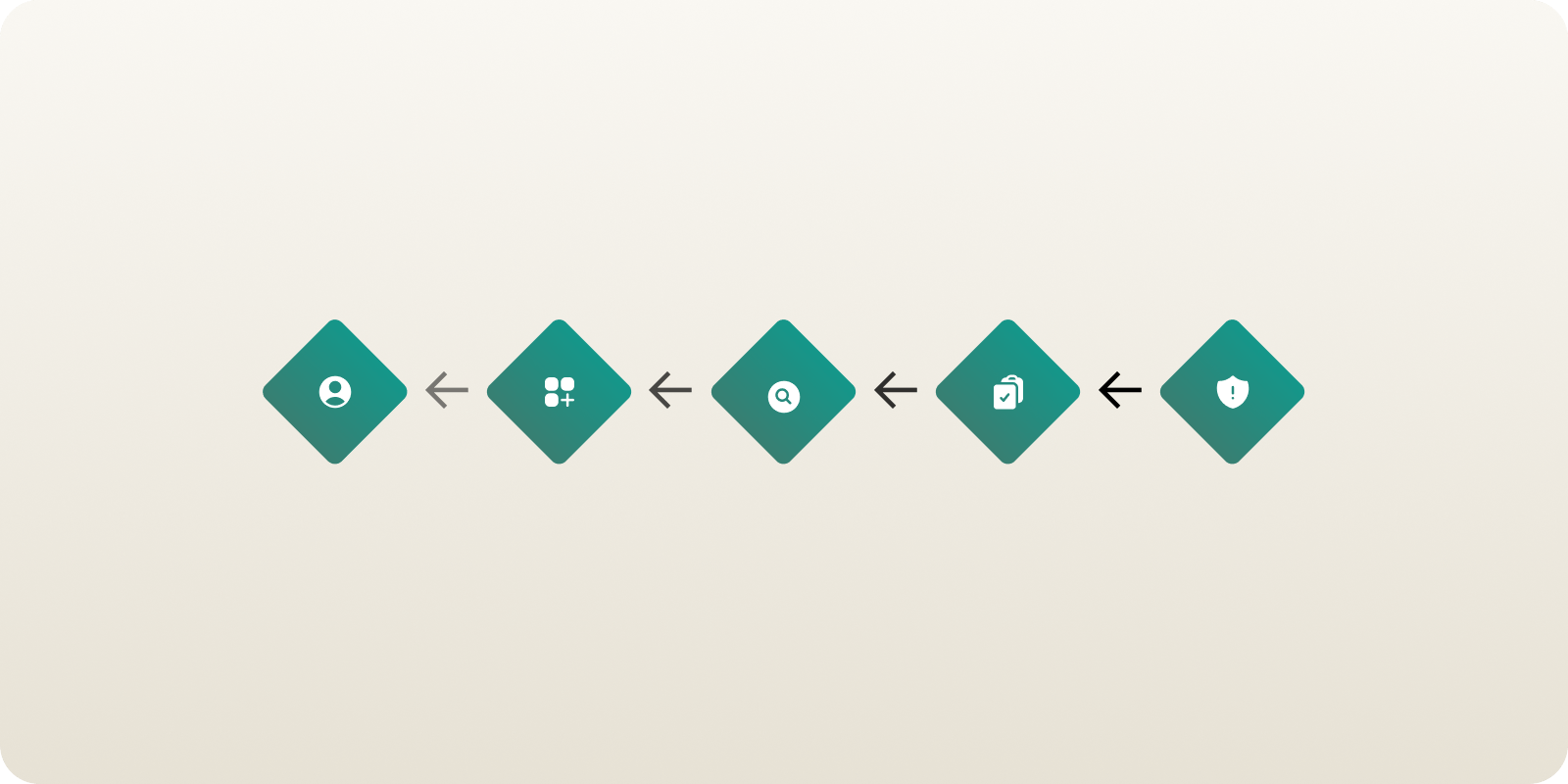

There are many organizations that provide proxy data. Here are five steps to finding a quality proxy data supplier:

❶ Develop a preliminary matching methodology:

To ensure that you can use the data from the proxy data supplier, you should develop a rough matching methodology. This methodology should include definitions or typologies of the key matching criteria, such as revenue, market cap, region, and industry. Remember, you will need this information on each of your portfolio companies in order to make an effective match to a set of companies in the proxy data set.

❷ Identify possible data providers:

The second step is to identify the available providers. You can do this by researching online or contacting industry associations for recommendations. Consider the provider's reputation, experience, and track record in the industry. If you have questions about where to look for recommendations, you can reach out to the Proof team here.

❸ Vet providers and familiarize yourself with the data:

Once you have a list of potential data providers, you should vet them by conducting due diligence. Ask any questions you may have about the data, including the methodology used to collect it, if their matching criteria is suitable to your own matching criteria, and the number of companies in the dataset. Then, along with your data team, ask for a data sample, a data dictionary, and API or other data delivery documentation to help you understand the quality and format of the data being provided. It is good to involve your data team early in the process to ensure compatibility.

❹ Evaluate customer support:

A good data provider should offer excellent customer support, which is particularly important given the complexities of the EU SFDR. Make sure that you can reach the provider if you have any questions or need assistance on data definitions. Consider the provider's response time, the quality of their support, and their willingness to help you.

❺ Compare your options and select your top provider:

Consider making a summary comparison table including each of the considered proxy data suppliers and how they rank on important criteria, such as the price and length of contract and their coverage across PAIs and regions, industries and company sizes.

Once you have finished negotiations and received the dataset from your proxy data supplier, you can begin the process of matching the proxy data with your collected data to aggregate the results for your SFDR reporting.

Finding a proxy data supplier can be a time- and resource-intensive process, but it is necessary if you want to ensure reporting compliance and full coverage across your portfolio. By following these steps, you can ensure that you find a reliable and trustworthy proxy data supplier to assist in your reporting under the SFDR. Feeling overwhelmed with the process? Request a demo of Proof’s automated SFDR-compliance solution that does the hard work for you.