Performance-Based Investing

How can sustainable investors further incentivize their portfolio companies to report robust sustainability data and improve their performance on material ESG and impact metrics? Performance-based investing is the next evolution of the sustainable investing market, and robust, verified data is critical to allow investors to incentivize positive results on quantitative performance indicators.

The sustainable investing market is growing exponentially. The Global Impact Investing Network (GIIN) estimates that there are approximately $715 million of impact investment assets under management (AUM), doubling from 2018 to 2020. The United States Social Innovation Fund (SIF) estimated an even larger sustainable investment market (investments that take environmental, social, and governance factors into account in investment decisions) of $11.6 trillion in 2018, up from $3.6 trillion in 2012. This accelerating global movement to use private capital for social good brings with it a greater demand among investors, asset managers, and fund managers to ensure their investments are making a positive impact.

To achieve this goal, the global impact and sustainable investment community has laid a fundamental groundwork of best practices, in the form of frameworks, standards, and principles, to help investors differentiate between impact investing (i.e., investments that intentionally contribute to measurable change), sustainable or responsible investing (i.e., investments that benefit stakeholders or avoid harm), and traditional investing. Although this first phase was important, there was a gap between theory and practice that centered squarely on insufficient data availability.

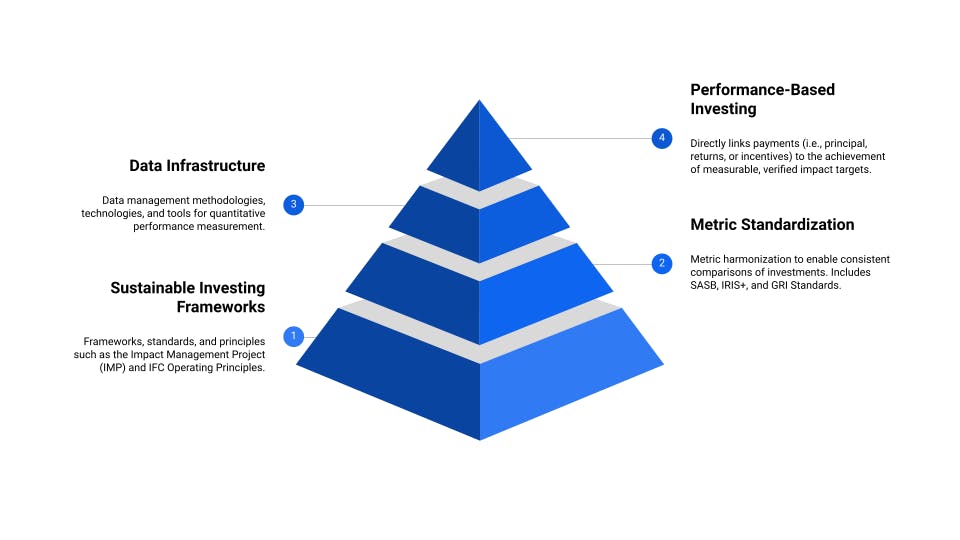

The ability to obtain reliable, detailed, and relevant performance data on investments is critical for investors to make informed decisions that align with their sustainability-driven goals and principles. As illustrated in Exhibit 1, the sustainable investing field is rapidly evolving with a focus on standardizing metrics, building necessary data infrastructure, and ultimately leveraging performance-based investing to incentivize change.

Exhibit 1: Evolutionary Phases of Sustainable Investing

Performance-based investing (PBI) directly links payments to the achievement of measurable, verified impact or sustainability targets. This provides investors with a new tool to go beyond simply guiding their investment and exit decisions to financially incentivizing their portfolio companies over the course of the investment to make business decisions that prioritize sustainability. PBIs can include a variety of financial instruments and approaches, such as interest rate rebates (i.e., impact-based loans), social impact incentives (i.e., bonuses for achieved performance), or social impact bonds.

As investors consider the introduction of PBI with their portfolio companies, there are three fundamental building blocks: materiality assessments, technology-based data collection, and independent results verification.

Building Block 1: Materiality Assessment

Research suggests that companies’ commitment to material impact and sustainability issues and metrics (i.e., those that are most relevant to the success of the organization) are critical to their financial success. A manufacturing company, for example, may place its highest material priority on its hazardous waste management and employee safety, whereas a health care company may place its highest material priority on patient health and data privacy.

A materiality assessment that accounts for the importance of the impact or sustainability issue to the business, as well as the importance to the stakeholders, is an emerging best practice included in the leading measurement standards. There are three key steps in a materiality assessment to prepare companies for PBI.

Materiality Map: Materiality maps help companies systematically consider different impact and sustainability issues that they believe have the greatest impact on their business, and where they want to focus their change efforts moving forward. SASB is one example of a financial materiality map with discrete sustainability issues.

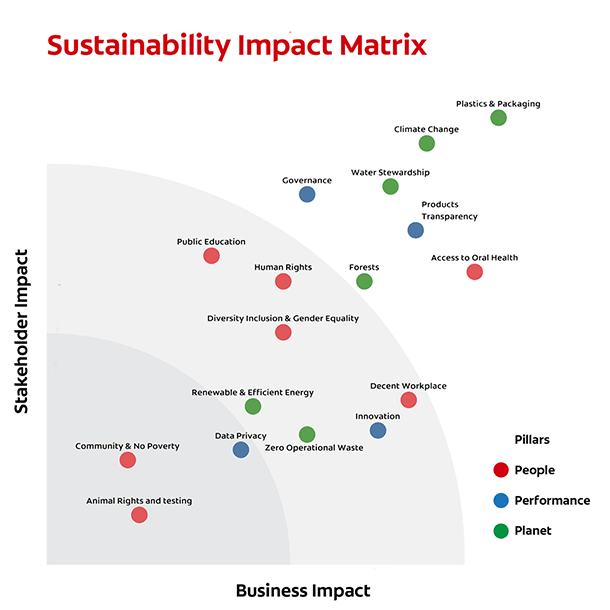

Materiality Ranking: The next step in determining which issues and metrics to prioritize in a PBI arrangement is to assign a ranking based on importance to the business and its stakeholders. A company can assess business importance, or financial materiality, through internal discussions among its leadership team. To determine importance to stakeholders, the company can survey customers, employees, communities, partners, and/or investors to rank the importance of each impact or sustainability issue. Once this data is collected, the company then plots each category on a scatter plot (see example below in Exhibit 2).

Metric Selection: The issues with the highest ranking for both business and stakeholder importance are where the company should set its measurable performance targets. Metric catalogues such as the IRIS have specific metrics to consider, and initiatives such as NYU’s Return on Social Impact (ROSI) can help companies quantify the financial implications of their improved sustainability performance.

Exhibit 2: Colgate-Palmolive Example Materiality Ranking Results

The completion of a materiality assessment is a critical step for investors to understand the impact and sustainability of their investments. In PBI arrangements, investors can offer companies an incentive payment for completion of the materiality assessment as a first step to ensure the incentives are linked to the most meaningful and relevant metrics.

Building Block 2: Technology-Based Data Collection

Recent advances and adoption in technologies and softwares that track everyday business operations — from CRMs to ERPs to payroll systems — have large amounts of data that is often relevant to sustainability metrics and ready to be converted into metrics. In addition to informing investors with the information needed to trigger performance payments, integration of these data into a centralized performance dashboard opens the door for more advanced analytics that add direct business value to the portfolio company (i.e., via investor relations, sales, marketing, and operational efficiencies).

Some companies will need to modify their workflows, data entry processes, and data management to build this data capacity. Investors who recognize this reality can build early incentives into PBIs that reward companies for improving their data infrastructure and consistently reporting performance on their material metrics over time. With this incentive structure in place, companies will unlock their potential to earn incentives on improvements of performance results over time or relative to industry benchmarks or targets.

Building Block 3: Independent Results Verification

Investors need to be assured that companies are not misrepresenting the data (intentionally or unintentionally). Given the high level of potential subjectivity (i.e., in data representation, interpretation, and calculation) involved in assessing performance, investors and their companies should ideally contract with a third-party data vendor with expertise in this area to verify the performance results.

Verification relies on a number of different factors (e.g., data collection methods, validation processes, and third party confirmations) that collectively build a burden of proof for the results depending on the capacity of each company. The culmination of the factors can be operationalized into an algorithm that calculates a numeric confidence score, with higher confidence scores signifying a stronger combination of data collection and verification techniques. This step gives funders a higher level of confidence that the impact was achieved, and allows them to set certain requirements before incentive payments are made.

Investors can build incentives into PBI contracts that encourage companies to engage in more rigorous verification techniques, which then reduces evidence risk (i.e., the “risk that insufficient high-quality data exists to know what impact is occurring”).

The Time for Performance-Based Investing is Now

As investors face growing pressure from their shareholders — and enterprises face increasing demand from their customers — to help address the existential threats facing our world, a new evolution of sustainable investing is emerging that can benefit people, profit, and planet. Performance-based investing (PBI), through the building blocks described above, can unlock trillions of investment dollars waiting on the sideline among investors who are waiting for higher proof that measurable change has occurred. PBI has the potential to drive systems change that pivot companies’ underlying business strategies and day-to-day operations away from the unsustainable status quo. With huge recent advances in technology, the new sustainable investment reality is within our grasp. Now is the time to embrace it.