ESG & Impact Data in Action: Insights from QNT

QNT is the first and only rebanking company in Colombia. QNT helps people in debt regain control of their finances and improve their credit scores until they can return to the financial system. In April 2021, QNT partnered with Proof to better service its customers, more rapidly monitor risks, and make the business more operationally efficient.

As described by Carlos Torres, QNT’s Corporate Vice President, “For QNT, a start up with a clear social focus, it was of crucial importance to find POI, in order to learn how to measure the real impact of our initiatives."

Automated ESG Strategy Creation

Using Proof’s comprehensive digital assessment, QNT first compared its current measurement and management approach against the leading industry frameworks — including the Impact Management Project’s (IMP’s) five dimensions, Global Impact Investing Network’s (GIIN’s) IRIS+ system, and United Nation Development Programme’s SDG Impact Standards — all in one centralized tool.

Equipped with the results and guidance from the assessment, QNT worked with Proof to develop a holistic ESG and impact strategy report, which included the following core components:

1. Purpose: Mission, vision, and background of the company

2. Need for QNT: How QNT helps correct for a market failure and fills an unmet financial need in Colombia

3. Measurement Strategy: Relevant industry frameworks, theory of change, and core ESG metrics, including product service metrics (e.g., average change in customer credit score, time spent in the program) and operational metrics (e.g., employee diversity, retention, wage equity)

4. Performance Management: Approach to ongoing tracking, analysis, and strategic action

5. Transparency: Plans for disclosure to investors and stakeholders

6. Governance: Board and oversight mechanisms to maintain a robust ESG measurement framework

Real-Time Data Feeds

With a strategy and metrics defined, it was critical that a financial technology business like QNT set up a sustainable, digital system for continuously monitoring its customers’ behavior, product usage, and financial health. This continuous, real-time measurement is helping QNT closely monitor any unintended risks that the product may have on lower-income customers, and creates a new opportunity for QNT to rapidly test and evaluate the effects of higher efficiency strategies. To achieve this goal, QNT seamlessly integrated its Google BigQuery data warehouse into the secure Proof Catalyst™ Data Management Portal. This upfront integration work set the stage for streaming data transfer, new analysis across data sets, and automated performance management against a core set of metrics.

Improved ESG Performance Showcasing

Prior to its commitment to ESG measurement, QNT had not systematically established its baseline ESG performance against a set of defined, meaningful metrics. With Proof, QNT was able to view its baseline performance in simple data visualizations and objectively track effectiveness over time as it tested new, higher efficiency business strategies.

QNT’s digital dashboard, for example, showed an average 31 percent increase in customers’ credit scores after completing the QNT rebanking program. This significant increase is a testament to QNT’s sustained, person-centered, and tailored approach to helping its customers. QNT’s trained customer managers meet with each customer at least once per month to understand their unique situation, develop a plan to resolve their existing financial challenges, and provide targeted financial education designed to shift everyday behaviors. Through the Proof product, QNT was able to clearly and reliably see its performance on this critical metric for the first time, begin rapidly testing the effect of new business strategies on credit score changes, and use the dashboard to showcase the business’s baseline impact to its investors and Board of Directors.

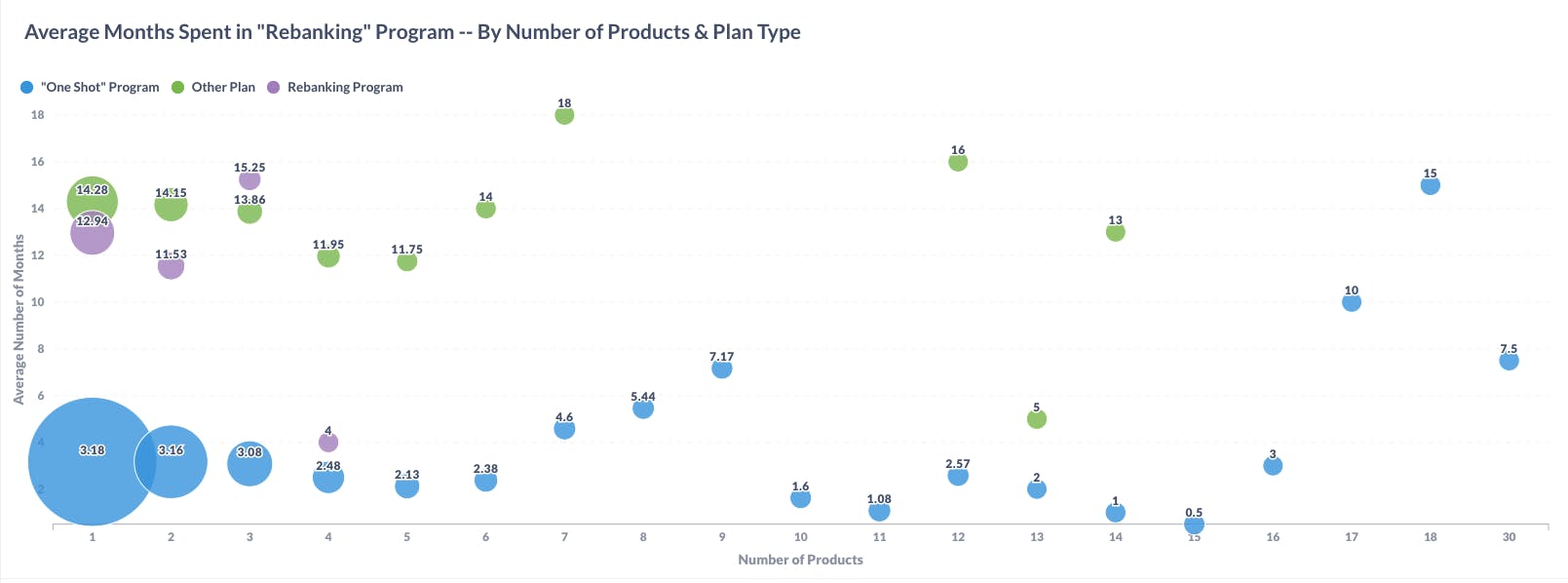

The data also revealed potential areas of improvement. For example, QNT wanted to know how long its customers usually stayed in its rebanking and other programs before receiving a completion certificate. Reducing the time that customers spend in the program would help both the customers (by regaining control of their finances and re-accessing the financial system faster) and the business (by reducing customer success resources). In partnership with Proof, QNT learned that the rebanking process took approximately 12-14 months; QNT believes that this time can be reduced by testing new strategies with different subsets of customers (e.g., lighter-touch digital “nudges” with earlier low-limit credit cards for lower risk customers). QNT will use the Proof dashboard to assess the effectiveness of these strategies on a real-time basis.

With its baseline performance established, QNT is now working to develop a concrete plan to optimize impact for all of its stakeholders.

Enhance Digital ESG Optimization

As QNT looks to the months ahead, the team plans to take the following steps to finalize and optimize its ESG measurement and performance results:

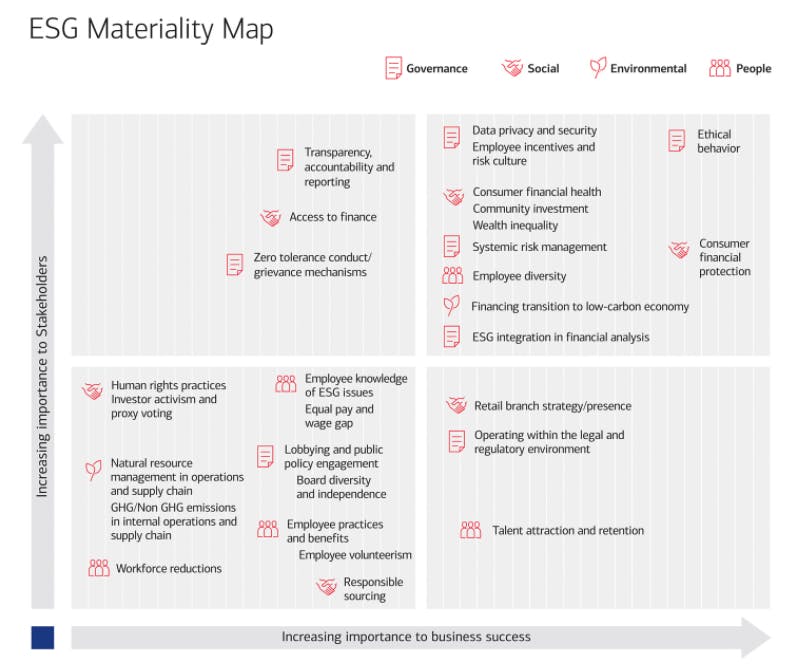

1. Stakeholder Materiality Assessment: To validate and refine its list of priority metrics in alignment with industry best practices, QNT will conduct a materiality assessment that collects feedback directly from the organization’s stakeholders (e.g., customers, employees, investors) and business leadership. Based on the stakeholder feedback, QNT will develop a materiality map of high-priority focus areas (see example from Bank of America below). The business will then add to its original metric list and begin testing the effects of higher-efficiency strategies on its stakeholders and financial bottom-line.

2. Expand to Internal Business Metrics: QNT started its measurement journey focused on assessing the impact of its product on its customer. Moving forward, QNT plans to expand the scope of its measurement to include internal operational metrics (e.g., employee and Board diversity, retention, wage equity), pulling from both the IRIS and SASB metrics and standards. This will provide QNT with a more holistic view of its total ESG and impact performance, and where it should direct its improvement and rapid testing efforts.

3. Collect Direct Stakeholder Data: In order to learn about the deeper longitudinal impact that the QNT product has on its customers’ livelihoods (e.g., savings behaviors, employment outcomes, family social outcomes), QNT plans to conduct automated digital surveys in an ongoing and cost-effective fashion. This will include exploring innovative techniques to increase response rates, such as collecting feedback via prepaid WhatsApp and SMS messages, with the ultimate goal of better understanding the long-term customer behaviors and opportunities for continued customer engagement.3.

As a result of QNT’s commitment to ESG measurement and management, the team now has the tools it needs to continuously assess its performance, rapidly test new strategies for higher business efficiency, and begin to transparently share its ESG performance on its journey to become a more sustainable and impactful business.

As summarized by Carlos Torres, QNT’s Corporate Vice President, “Proof helps us understand how far we still are from achieving our goals, but they also encourage the company to reach them. Proof has mentored us in many ways, and helped us develop clear objectives through the implementation of the dashboard and its KPIs.”

Proof is proud to partner with QnT in achieving their impact and financial goals. We look forward to continuing this partnership and democratizing access to high quality, data-driven impact measurement and active performance management. If you’d like to learn more, please contact us via our website.